前篇:忠意保險 跨越創富保2 IRR分析

為兩年期繳,

本篇改用五年期繳試算

點此或下圖可以連結FB討論串

以下為香港 忠意保險 跨越創富保2 的建議書

(五年期繳)

分別為退保(解約)/身故:

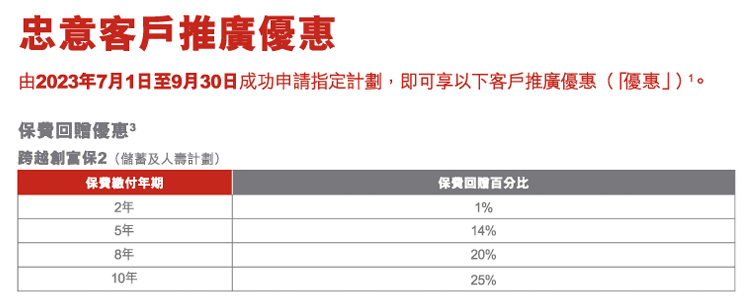

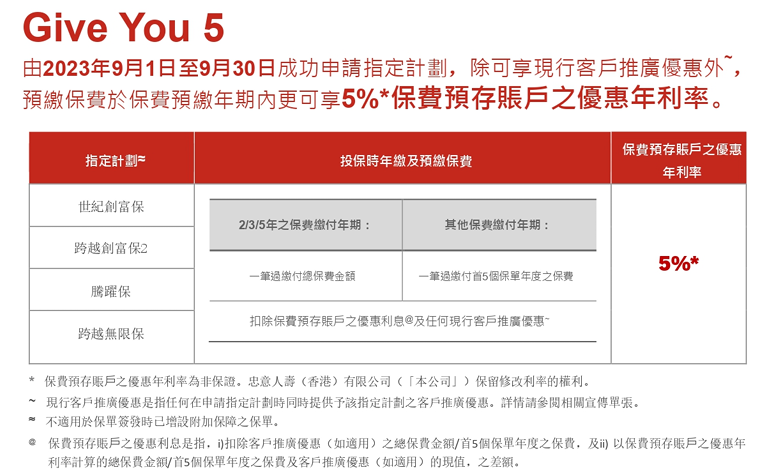

建議書未考慮其他折扣

依此建議書計算略為低估IRR:

計算IRR之前,

先了解一下這家保險公司

取自維基百科:

忠意保險(Assicurazioni Generali S.p.A.),又稱忠利集團(Generali Group),前稱忠利保險,是義大利的一家保險公司。這家保險公司是義大利最大,世界第三大的保險公司[1],總部位於第里雅斯特[2]。2010年時,忠意保險的收入在世界保險集團中排名第二,僅次於安盛。

python code:

# -*- coding: utf-8 -*-

"""

Created on Tue May 23 18:57:45 2023

@author: SavingKing

03:

j,k合為同一個迴圈(死亡IRR),且使用enumerate

df使用"年"當index,以免cash_value,death_insurance

資料的年度不一致,還可以正確合併

"""

import numpy_financial as npf

import numpy as np

import pandas as pd

import os

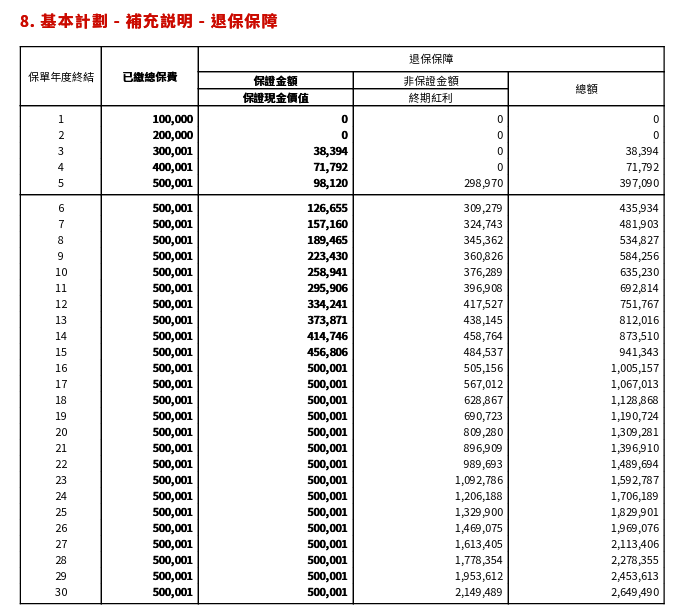

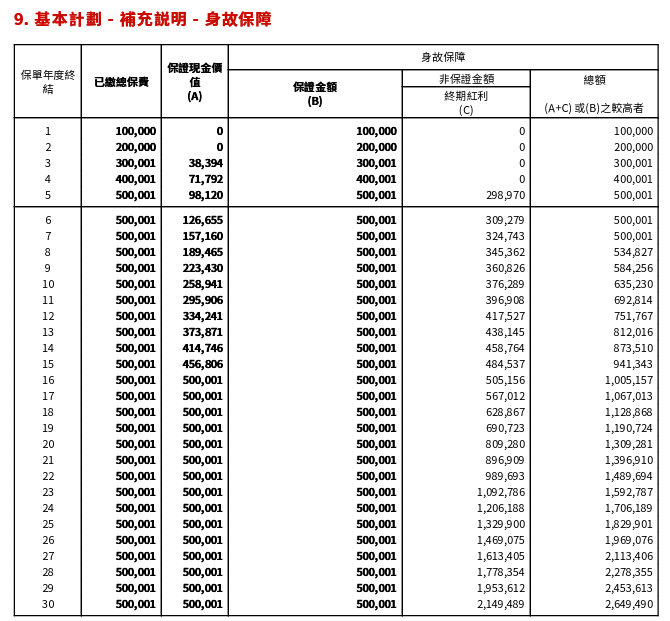

cash_value:list=[0, 0, 38394, 71792, 397090,

435934, 481903, 534827, 584256, 635230,

692814, 751767, 812016, 873510, 941343,

1005157,1067013,1128868,1190724,1309281]

#忠意人壽 創富保2 #1~20年末解約金(上),死亡保額(下)

death_insurance:list=[100000, 200000, 300001, 400001, 500001,

500001, 500001, 534827, 584256, 635230,

692814, 751767, 812016, 873510, 941343,

1005157,1067013,1128868,1190724,1309281]

rate=210/100 #30歲以下

#180/100 if 31~40歲

#160/100 if 41~50歲

cash_valueXrate:list = list( np.array(cash_value) * rate )

capital_protection = 8

increasing_rate = [np.nan]*capital_protection #12年末保本

#從保本才開始算解約金增加率

for i in range(capital_protection, len(cash_value)):

increase = cash_value[i]/cash_value[i-1]-1

increasing_rate.append(increase)

"""

len(increasing_rate)

Out[24]: 15

"""

discount = (0)/100 #花旗,星展,華南

# 樂天10萬回饋2500(2.5%)

# 遠銀百萬保費3.5%

pay:float = -100000* (1-discount) #-60570 #-59358.6

n_years = 5

lisIRR_death = []

for i, value in enumerate(death_insurance, 0):

if i < n_years: #i=0,1,2

cash_flow = [pay]*(i+1)+[death_insurance[i]]

else:

lis0 = [0]*(i-n_years+1)

cash_flow = [pay]*n_years+lis0+[value]

print(f"第{i+1:02d}年末死亡cashflow:",cash_flow)

irr = npf.irr(cash_flow)

lisIRR_death.append(irr)

for m,irr in enumerate(lisIRR_death,1):

print(f"第{m:02d}年末({m+40}歲)死亡IRR:\t{irr:.4%}")

lisIRR_death = [f"{irr:.4%}" for irr in lisIRR_death]

dic={"死亡IRR":lisIRR_death , "年": list(range(1,len(death_insurance)+1))}

dfIRR_death = pd.DataFrame(dic).set_index("年")

#以"年"當index,以免cash_value跟death_insurance資料不一致

#這樣合併資料還可以正確

lisIRR = []

totReturn = []

for i, value in enumerate(cash_value, 0):

if i < n_years: #i=0,1,2

cash_flow = [pay]*(i+1)+[cash_value[i]]

else:

lis0 = [0]*(i-n_years+1)

cash_flow = [pay]*n_years+lis0+[value]

print(f"第{i+1:02d}年末cashflow:",cash_flow)

irr = npf.irr(cash_flow)

lisIRR.append(irr)

tot = sum(cash_flow)/abs(sum([pay]*n_years))

totReturn.append(tot)

lisIRRx2 = [] #0歲女其實是*2.1倍

for i, value in enumerate(cash_valueXrate, 0):

if i < n_years: #i=0,1,2

# cash_flow = [pay]*(i+1)+[cash_valueXrate[i]]

cash_flow = [pay]*(i+1)+[value]

else:

lis0 = [0]*(i-n_years+1)

cash_flow = [pay]*n_years+lis0+[value]

print(f"第{i+1:02d}年末cashflow X rate:",cash_flow)

irr = npf.irr(cash_flow)

lisIRRx2.append(irr)

lisIRR = [f"{irr:.4%}" for irr in lisIRR]

totReturn = [f"{ele:.4%}" for ele in totReturn]

increasing_rate = [f"{ele:.4%}" for ele in increasing_rate]

# lisIRR_death = [f"{ele:.4%}" for ele in lisIRR_death]

lisIRRx2 = [f"{irr:.4%}" for irr in lisIRRx2]

dic = {

"年" : list(range(1, len(cash_value)+1)),

"IRR" : lisIRR,

"總報酬率" : totReturn,

"增加率" : increasing_rate,

#"解約金x2.1_IRR": lisIRRx2

# "死亡IRR" : lisIRR_death

}

df = pd.DataFrame(dic).set_index("年")

df_concat = pd.concat([df,dfIRR_death],axis=1)

print("\n",df_concat)

cwd = os.getcwd()

exFolder = os.path.join(cwd,"export")

if not os.path.exists(exFolder):

os.makedirs(exFolder)

xlsx_path = "\\".join( [exFolder,"irr.xlsx"] )

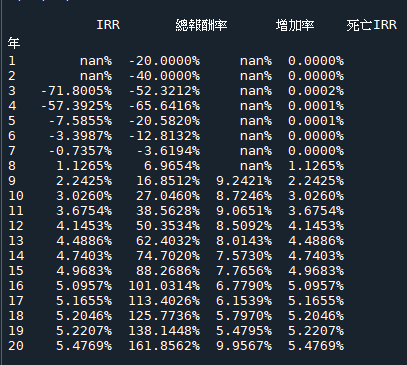

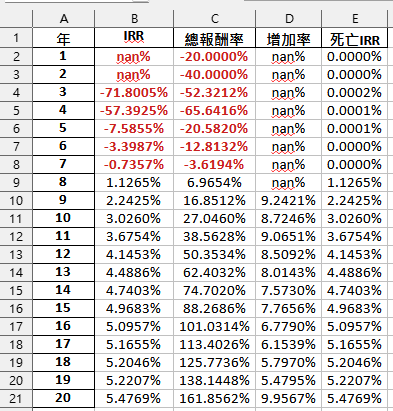

df_concat.to_excel(xlsx_path)輸出結果:

輸出的xlsx檔案:

對比於兩年期繳的跨越創富保2

五年內解約皆為負報酬

五年期繳負報酬的時間更延長了

七年內解約皆為負報酬

死亡則為0利率

八年保本

之後解約金增加率約8%

算越長IRR越高

20年IRR 5.5%

跟兩年期繳的跨越創富保2一樣

海外保單當然不受到台灣政府的保障

但我想比美國券商倒閉的風險低多了

至少香港很近,

講中文也會通

也沒看過有人擔憂

美國券商倒閉的問題

本文只為客觀揭露商品IRR

其他風險均應自行考量

若您厭倦了金管會黑手干預

台灣儲蓄險IRR低落

香港保單是您另外的選擇

推薦hahow線上學習python: https://igrape.net/30afN

近期留言