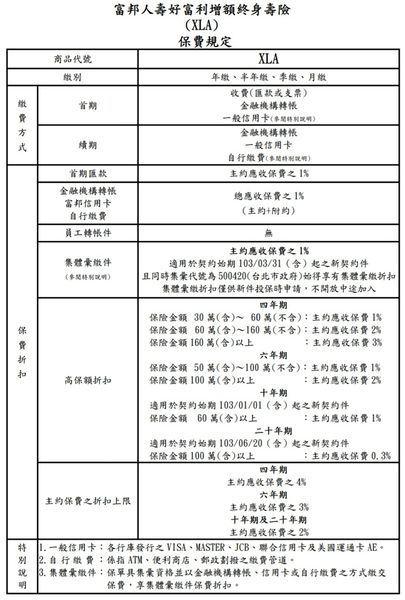

雖然是停售商品,

但太多人想問期繳商品,

讓大家看一下優秀的期繳商品長什麼樣子

附加費用0.2%,宣告利率2.11%

前六年有提前解約費用

每年投入100萬保費

(扣除0.2%附加費用,淨保費為99.8萬,

僅為舉例,保費門檻跟現售商品金滿意,金好利一樣低),

六年末解約金:644.6097

| 99.8 | 2.11% | 101.9058 |

| 99.8 | 2.11% | 205.9618 |

| 99.8 | 2.11% | 312.2133 |

| 99.8 | 2.11% | 420.7068 |

| 99.8 | 2.11% | 531.4895 |

| 99.8 | 2.11% | 644.6097 |

|

-100 |

| -100 |

| -100 |

| -100 |

| -100 |

| -100 |

| 644.6097 |

| 2.053% |

六年IRR=2.053%

並非期繳商品,就找不到IRR>2%的商品

請不要聽信業務員的任何話術

儲蓄險較高的利率,乃是犧牲流動性得來的

IRR<2%,不如定存,也無需遷就地雷保單

改以躉繳方式計算好得意IRR

| 年度末 | 好得意1~5年保價金IRR | ||||

| 0 | -100 | -100 | -100 | -100 | -100 |

| 1 | 101.9058 | 0 | 0 | 0 | 0 |

| 2 | 104.056 | 0 | 0 | 0 | |

| 3 | 106.2516 | 0 | 0 | ||

| 4 | 108.4935 | 0 | |||

| 5 | 110.7827 | ||||

| IRR | 1.9058% | 2.0078% | 2.0419% | 2.0589% | 2.0691% |

| 年度末 | 好得意6~10年保價金=解約金IRR | ||||

| 0 | -100 | -100 | -100 | -100 | -100 |

| 1 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 |

| 3 | 0 | 0 | 0 | 0 | 0 |

| 4 | 0 | 0 | 0 | 0 | 0 |

| 5 | 0 | 0 | 0 | 0 | 0 |

| 6 | 113.1202 | 0 | 0 | 0 | 0 |

| 7 | 115.507 | 0 | 0 | 0 | |

| 8 | 117.9442 | 0 | 0 | ||

| 9 | 120.4329 | 0 | |||

| 10 | 122.974 | ||||

| IRR | 2.0759% | 2.0808% | 2.0845% | 2.0873% | 2.0896% |

保價金月化IRR*12:

| 淨保費 | 99.8 | 附加費用 | 0.20% | 宣告利率 | 2.11% | |

| 月 | -100 | -100 | -100 | -100 | -100 | -100 |

| 1 | 99.9755 | 0 | 0 | 0 | 0 | 0 |

| 2 | 100.1513 | 0 | 0 | 0 | 0 | |

| 3 | 100.3274 | 0 | 0 | 0 | ||

| 4 | 100.5038 | 0 | 0 | |||

| 5 | 100.6805 | 0 | ||||

| 6 | 100.8575 | |||||

| IRR | -0.2942% | 0.9073% | 1.3081% | 1.5085% | 1.6288% | 1.7090% |

| 淨保費 | 99.8 | 附加費用 | 0.20% | 宣告利率 | 2.11% | |

| 月 | -100 | -100 | -100 | -100 | -100 | -100 |

| 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | 0 | 0 | 0 | 0 | 0 | 0 |

| 4 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5 | 0 | 0 | 0 | 0 | 0 | 0 |

| 6 | 0 | 0 | 0 | 0 | 0 | 0 |

| 7 | 101.0349 | 0 | 0 | 0 | 0 | 0 |

| 8 | 101.2125 | 0 | 0 | 0 | 0 | |

| 9 | 101.3905 | 0 | 0 | 0 | ||

| 10 | 101.5688 | 0 | 0 | |||

| 11 | 101.7474 | 0 | ||||

| 12 | 101.9263 | |||||

| IRR | 1.7662% | 1.8092% | 1.8426% | 1.8694% | 1.8912% | 1.9095% |

2016/1月將調降宣告利率為2.03%

以宣告利率2.03%計算保價金IRR:

| 0 | -100 | -100 | -100 | -100 | -100 | -100 |

| 1 | 101.8259 | 0 | 0 | 0 | 0 | 0 |

| 2 | 103.8930 | 0 | 0 | 0 | 0 | |

| 3 | 106.0020 | 0 | 0 | 0 | ||

| 4 | 108.1539 | 0 | 0 | |||

| 5 | 110.3494 | 0 | ||||

| 6 | 112.5895 | |||||

| IRR | 1.8259% | 1.9279% | 1.9619% | 1.9789% | 1.9892% | 1.9960% |

| 年 | IRR | 台銀三年 | 絕對利差 | 相對利差 |

| 1 | 1.8259% | 1.305% | 0.5209% | 39.92% |

| 2 | 1.9279% | 1.305% | 0.6229% | 47.73% |

| 3 | 1.9619% | 1.305% | 0.6569% | 50.34% |

| 4 | 1.9789% | 1.305% | 0.6739% | 51.64% |

| 5 | 1.9892% | 1.305% | 0.6842% | 52.43% |

| 6 | 1.9960% | 1.305% | 0.6910% | 52.95% |

IRR算法在此

http://tw.gigacircle.com/2741722-1

或者比對板上的級距表也很清楚

業務員的3%想必不大妙,

尤其是期繳的增額壽險

通常減額繳清損失比較小

年繳11850,六年末解約金?

77790?你列的現金流,再用IRR公式即可計算

六年末解約金是77790?

算過這樣是2.5750%,

四捨五入後還真的是3% =.=

嗯嗯,感謝您的回覆^^ 看來這業務員略有誇大,不過看來仍有2.5%的水準,依照您的此站的建議,似乎仍有保留的空間(不至於太差、比定存低等),不過因為以美元繳費,有某部份的匯差風險就是了。

再次謝謝您的時間幫我分析 Thank you!!

美金儲蓄險應有頗接近3%的水準,

而且請確定六年末解約金是77790

我看不大懂妳的意思

六年末是75162

那irr就不到2.5%了

現在沒有NB可以用

你列的現金流,最後一欄補上75162

再用IRR公式即可算出

即使還不知道準確的IRR,

還是可以準備減額繳清了

減額繳清後,六年末解約金多少?

終究還是要學會算IRR才知道怎麼處理好

已為您開一篇美利富的新文章

http://savingking.com.tw/blog/post/251572687

請參考

損失最少的方式就是

收集業務員不實推銷的錄音證據後,

跟金管會與評議中心申訴,

要求業務員補足到irr 3%