建議書由保經業務提供,若需推薦,

請至儲蓄保險王粉絲團私訊

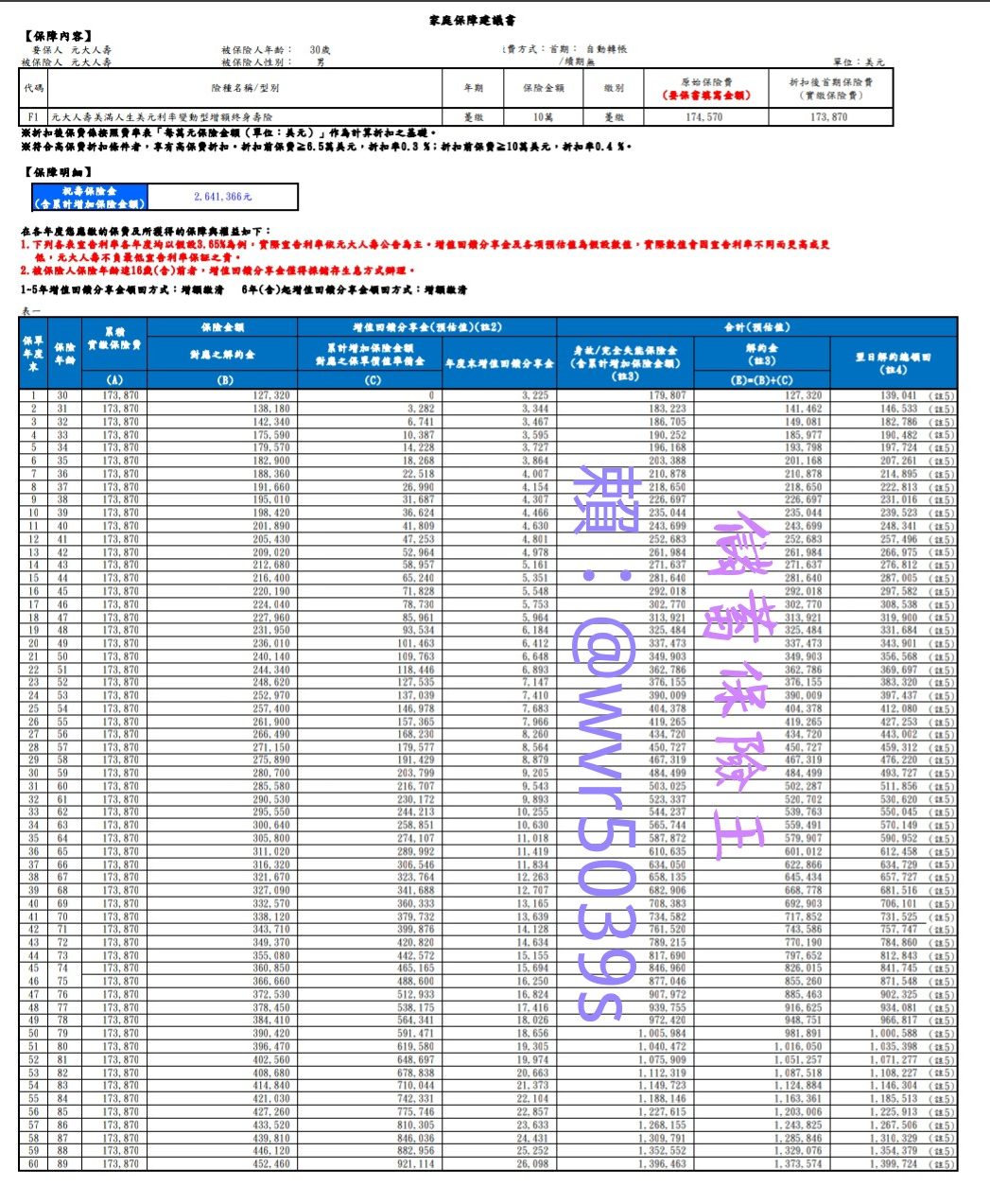

宣告利率:3.65% (2019/4~6月)

依據建議書

表定保費是174570

享0.4%折扣後

實繳保費應為173872

但是建議書卻寫173870

低了2美金

會造成這個誤差的原因

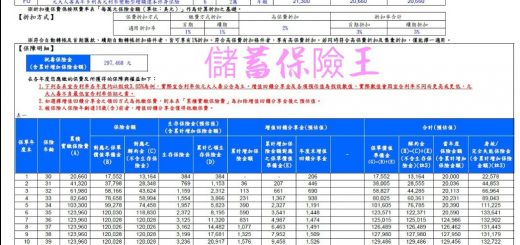

元大人壽珍利美(FP)美元利率變動型終身壽險(六年期繳)IRR分析,最高4%折扣

已經解釋過了

原始保費30114

30114*(1-4%) =28909.44

但建議書顯示的折扣後保費是28908

比上述計算低了1.44美金

這誤差是因為4%折扣從

每萬保額的保費開始計算

再乘上18萬保額

會放大四捨五入的結果

但為了方便計算,

仍用原始保費*(1-折扣率)

基本上誤差非常小

硬要講誤差的話

那也是高估了保費

低估了IRR

看完建議書

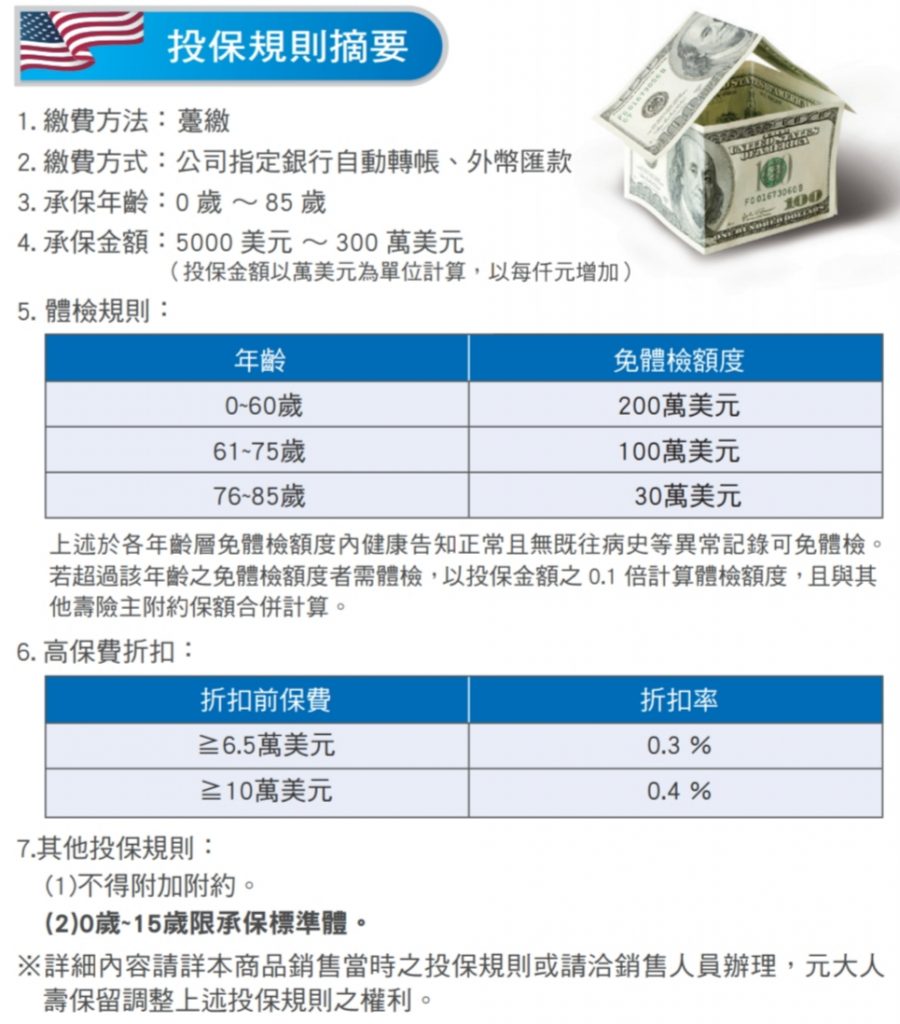

看高保費折扣

6.5萬美金以上: 0.3% (台幣202萬)

10萬美金以上: 0.4% (台幣310萬)

算法如下:

IRR(內部報酬率):計算六年IRR,為何要將六年末解約金放在現金流的第”七”欄位

不同保費折扣IRR統整在前:

儲蓄保險王 賴: @wvr5039s 儲蓄保險王 台幣門檻 (萬元) 310 201.5 15.5 美金門檻 (萬元) 10 6.5 0.5 折扣 0.4% 0.3% 0 年 IRR IRR IRR 1 -20.03% -20.11% -20.35% 2 -8.20% -8.24% -8.38% 3 1.6806% 1.6466% 1.5448% 4 2.3072% 2.2815% 2.2048% 5 2.6044% 2.5838% 2.5222% 6 2.9710% 2.9537% 2.9022% 7 3.0724% 3.0576% 3.0134% 8 3.1487% 3.1358% 3.0971% 9 3.2078% 3.1963% 3.1619% 10 3.2552% 3.2448% 3.2138% 11 3.2939% 3.2844% 3.2562% 12 3.3265% 3.3179% 3.2920% 13 3.3538% 3.3458% 3.3219% 14 3.3774% 3.3699% 3.3478% 15 3.3977% 3.3907% 3.3700% 16 3.4156% 3.4091% 3.3897% 17 3.4312% 3.4251% 3.4069% 18 3.4452% 3.4394% 3.4222% 19 3.4577% 3.4523% 3.4359% 20 3.4690% 3.4638% 3.4483%

0.4%折扣 (310萬台幣):

FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 FB: 儲蓄保險王 宣告 表定保費 174570.0 折扣 美金鑽 2% 賴: @wvr5039s 3.7% 實繳保費 173871.7 0.4% 解約金 定存 美金儲蓄險勝出 年 解約金 IRR 總報酬率 增加率 總報酬率 絕對利差 相對利差 1 139041 -20.03% -20.03% 2.00% 2 146533 -8.20% -15.72% 4.04% 3 182786 1.68% 5.13% 6.12% 4 190482 2.31% 9.55% 4.21% 8.24% 0.33% 15.89% 5 197724 2.60% 13.72% 3.80% 10.41% 0.66% 31.80% 6 207261 2.97% 19.20% 4.82% 12.62% 1.10% 52.21% 7 214895 3.07% 23.59% 3.68% 14.87% 1.25% 58.68% 8 222813 3.15% 28.15% 3.68% 17.17% 1.37% 63.98% 9 231016 3.21% 32.87% 3.68% 19.51% 1.48% 68.46% 10 239523 3.26% 37.76% 3.68% 21.90% 1.59% 72.42% 11 248341 3.29% 42.83% 3.68% 24.34% 1.68% 75.98% 12 257496 3.33% 48.10% 3.69% 26.82% 1.77% 79.30% 13 266975 3.35% 53.55% 3.68% 29.36% 1.86% 82.38% 14 276812 3.38% 59.20% 3.68% 31.95% 1.95% 85.32% 15 287005 3.40% 65.07% 3.68% 34.59% 2.03% 88.13% 16 297582 3.42% 71.15% 3.69% 37.28% 2.12% 90.86% 17 308538 3.43% 77.45% 3.68% 40.02% 2.20% 93.51% 18 319900 3.45% 83.99% 3.68% 42.82% 2.29% 96.12% 19 331684 3.46% 90.76% 3.68% 45.68% 2.37% 98.69% 20 343901 3.47% 97.79% 3.68% 48.59% 2.46% 101.24%

兩年內解約為虧損負報酬

3,4年IRR約同定存水準

3 -> 4年解約金增加率4.2%

5 -> 6年解約金增加率4.8%

6年IRR 3%,相對利差勝出定存52%

長期解約金增加率3.7%

20年總報酬率97.79%,接近資產翻倍

0.3%折扣 (202萬台幣):

FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 FB: 儲蓄保險王 宣告 表定保費 174570.0 折扣 美金鑽 2% 賴: @wvr5039s 3.7% 實繳保費 174046.3 0.3% 解約金 定存 美金儲蓄險勝出 年 解約金 IRR 總報酬率 增加率 總報酬率 絕對利差 相對利差 1 139041 -20.11% -20.11% 2.00% 2 146533 -8.24% -15.81% 4.04% 3 182786 1.65% 5.02% 6.12% 4 190482 2.28% 9.44% 4.21% 8.24% 0.30% 14.56% 5 197724 2.58% 13.60% 3.80% 10.41% 0.64% 30.71% 6 207261 2.95% 19.08% 4.82% 12.62% 1.08% 51.26% 7 214895 3.06% 23.47% 3.68% 14.87% 1.23% 57.85% 8 222813 3.14% 28.02% 3.68% 17.17% 1.36% 63.23% 9 231016 3.20% 32.73% 3.68% 19.51% 1.47% 67.78% 10 239523 3.24% 37.62% 3.68% 21.90% 1.57% 71.79% 11 248341 3.28% 42.69% 3.68% 24.34% 1.67% 75.40% 12 257496 3.32% 47.95% 3.69% 26.82% 1.76% 78.74% 13 266975 3.35% 53.39% 3.68% 29.36% 1.85% 81.85% 14 276812 3.37% 59.05% 3.68% 31.95% 1.94% 84.82% 15 287005 3.39% 64.90% 3.68% 34.59% 2.02% 87.65% 16 297582 3.41% 70.98% 3.69% 37.28% 2.11% 90.40% 17 308538 3.43% 77.27% 3.68% 40.02% 2.19% 93.07% 18 319900 3.44% 83.80% 3.68% 42.82% 2.28% 95.69% 19 331684 3.45% 90.57% 3.68% 45.68% 2.36% 98.27% 20 343901 3.46% 97.59% 3.68% 48.59% 2.45% 100.83%

0%折扣(16萬台幣):

| FB: | 儲蓄保險王 | 賴: | @wvr5039s | 儲蓄保險王 | FB: | 儲蓄保險王 | |

| 宣告 | 表定保費 | 174570.0 | 折扣 | 美金鑽 | 2% | 賴: | @wvr5039s |

| 3.7% | 實繳保費 | 174570.0 | 0.0% | 解約金 | 定存 | 美金儲蓄險勝出 | |

| 年 | 解約金 | IRR | 總報酬率 | 增加率 | 總報酬率 | 絕對利差 | 相對利差 |

| 1 | 139041 | -20.35% | -20.35% | 2.00% | |||

| 2 | 146533 | -8.38% | -16.06% | 4.04% | |||

| 3 | 182786 | 1.54% | 4.71% | 6.12% | |||

| 4 | 190482 | 2.20% | 9.11% | 4.21% | 8.24% | 0.22% | 10.58% |

| 5 | 197724 | 2.52% | 13.26% | 3.80% | 10.41% | 0.57% | 27.43% |

| 6 | 207261 | 2.90% | 18.73% | 4.82% | 12.62% | 1.02% | 48.43% |

| 7 | 214895 | 3.01% | 23.10% | 3.68% | 14.87% | 1.18% | 55.36% |

| 8 | 222813 | 3.10% | 27.64% | 3.68% | 17.17% | 1.31% | 60.99% |

| 9 | 231016 | 3.16% | 32.33% | 3.68% | 19.51% | 1.43% | 65.74% |

| 10 | 239523 | 3.21% | 37.21% | 3.68% | 21.90% | 1.53% | 69.90% |

| 11 | 248341 | 3.26% | 42.26% | 3.68% | 24.34% | 1.63% | 73.64% |

| 12 | 257496 | 3.29% | 47.50% | 3.69% | 26.82% | 1.72% | 77.09% |

| 13 | 266975 | 3.32% | 52.93% | 3.68% | 29.36% | 1.81% | 80.29% |

| 14 | 276812 | 3.35% | 58.57% | 3.68% | 31.95% | 1.90% | 83.32% |

| 15 | 287005 | 3.37% | 64.41% | 3.68% | 34.59% | 1.99% | 86.22% |

| 16 | 297582 | 3.39% | 70.47% | 3.69% | 37.28% | 2.07% | 89.02% |

| 17 | 308538 | 3.41% | 76.74% | 3.68% | 40.02% | 2.16% | 91.74% |

| 18 | 319900 | 3.42% | 83.25% | 3.68% | 42.82% | 2.25% | 94.40% |

| 19 | 331684 | 3.44% | 90.00% | 3.68% | 45.68% | 2.33% | 97.02% |

| 20 | 343901 | 3.45% | 97.00% | 3.68% | 48.59% | 2.42% | 99.61% |

近期留言