首集的槓桿投資新光美旺福

以利率2.5%的本息平均攤提信貸為例

(加賴: @wvr5039s,傳訊1,會回覆相關資料)

則說明2%以下的信貸並非憑空想像

甚至軍公教都還可以借1.6%的信貸

中壽美鑫跟新光美旺福比起來

可以說是旗鼓相當,難分軒輊

本篇要用更低的2%信貸利率計算

槓桿投資中國人壽美鑫(0.3%折扣)的結果

貸款: 1000000 (100萬)

利率: 2%

期數: 84個月 (7年)

月付本息=12768

相當於年付本息15.3216萬

以下很可怕!不要問!不解釋!

連我自己都不知道在算什麼 XD

欲索取槓桿投資的原始Excel檔

請加賴: @wvr5039s,傳訊1

@wvr5039s FB: 儲蓄保險王 賴: @wvr5039s 本金: 100 匯率: 30.7 貸款利率: 2.00% 虧損

匯率月 年 美鑫IRR 解約金 貸款餘額 解約金-餘額 36 3 2.0700% 106.3394 58.8474 47.4920 30.26 48 4 2.7118% 111.2964 44.5724 66.7240 29.20 60 5 2.9784% 115.8062 30.0094 85.7968 28.26 72 6 3.3099% 121.5768 15.1523 106.4245 27.04 84 7 3.4142% 126.4913 0 126.4913 26.03 96 8 3.4924% 131.6032 0 131.6032 25.02 108 9 3.5530% 136.9192 0 136.9192 24.05 120 10 3.6022% 142.4591 0 142.4591 23.11 132 11 3.6414% 148.2058 0 148.2058 22.22 144 12 3.6745% 154.1931 0 154.1931 21.35 156 13 3.7023% 160.4156 0 160.4156 20.53 168 14 3.7264% 166.8974 0 166.8974 19.73 180 15 3.7475% 173.6464 0 173.6464 18.96 192 16 3.7657% 180.6599 0 180.6599 18.23 204 17 3.7815% 187.9473 0 187.9473 17.52 216 18 3.7960% 195.5470 0 195.5470 16.84 228 19 3.8087% 203.4426 0 203.4426 16.18 240 20 3.8202% 211.6578 0 211.6578 15.56

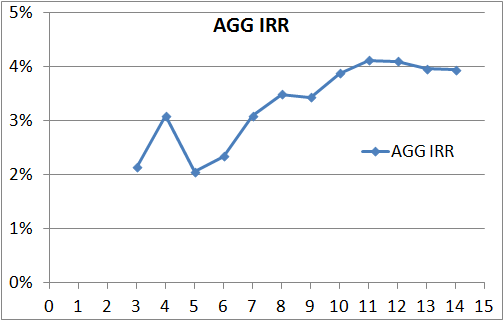

統整在前:

| FB: | 儲蓄保險王 | @wvr5039s |

| 年 | IRR | 總報酬率 |

| 3 | 1.64% | 3.32% |

| 4 | 3.43% | 8.87% |

| 5 | 3.80% | 11.99% |

| 6 | 4.20% | 15.77% |

| 7 | 4.13% | 17.94% |

| 8 | 4.11% | 22.71% |

| 9 | 4.10% | 27.66% |

| 10 | 4.09% | 32.83% |

| 11 | 4.08% | 38.19% |

| 12 | 4.08% | 43.77% |

| 13 | 4.07% | 49.57% |

| 14 | 4.07% | 55.61% |

| 15 | 4.07% | 61.91% |

| 16 | 4.07% | 68.45% |

| 17 | 4.06% | 75.24% |

| 18 | 4.06% | 82.33% |

| 19 | 4.06% | 89.69% |

| 20 | 4.06% | 97.35% |

現金流排列在後:

年 FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 0 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 1 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 2 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 3 47.4920 -15.3216 -15.3216 -15.3216 -15.3216 4 66.7240 -15.3216 -15.3216 -15.3216 5 85.7968 -15.3216 -15.3216 6 106.4245 -15.3216 7 126.4913 IRR 1.64% 3.43% 3.80% 4.20% 4.13% 年 3 4 5 6 7 總本金 45.9648 61.2864 76.6080 91.9296 107.2512 總利息 1.5272 5.4376 9.1888 14.4949 19.2401 總報酬率 3.32% 8.87% 11.99% 15.77% 17.94%

年 儲蓄保險王 賴: @wvr5039s 0 -15.3216 -15.3216 -15.3216 1 -15.3216 -15.3216 -15.3216 2 -15.3216 -15.3216 -15.3216 3 -15.3216 -15.3216 -15.3216 4 -15.3216 -15.3216 -15.3216 5 -15.3216 -15.3216 -15.3216 6 -15.3216 -15.3216 -15.3216 7 0 0 0 8 131.6032 0 0 9 136.9192 0 10 142.4591 IRR 4.11% 4.10% 4.09% 年 8 9 10 總本金 107.2512 107.2512 107.2512 總利息 24.3520 29.6680 35.2079 總報酬率 22.71% 27.66% 32.83%

年 FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 0 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 1 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 2 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 3 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 4 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 5 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 6 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 7 0 0 0 0 0 8 0 0 0 0 0 9 0 0 0 0 0 10 0 0 0 0 0 11 148.2058 0 0 0 0 12 154.1931 0 0 0 13 160.4156 0 0 14 166.8974 0 15 173.6464 IRR 4.08% 4.08% 4.07% 4.07% 4.07% 年 11 12 13 14 15 總本金 107.2512 107.2512 107.2512 107.2512 107.2512 總利息 40.9546 46.9419 53.1644 59.6462 66.3952 總報酬率 38.19% 43.77% 49.57% 55.61% 61.91%

年 FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 0 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 1 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 2 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 3 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 4 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 5 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 6 -15.3216 -15.3216 -15.3216 -15.3216 -15.3216 7 0 0 0 0 0 8 0 0 0 0 0 9 0 0 0 0 0 10 0 0 0 0 0 11 0 0 0 0 0 12 0 0 0 0 0 13 0 0 0 0 0 14 0 0 0 0 0 15 0 0 0 0 0 16 180.6599 0 0 0 0 17 187.9473 0 0 0 18 195.5470 0 0 19 203.4426 0 20 211.6578 IRR 4.07% 4.06% 4.06% 4.06% 4.06% 年 16 17 18 19 20 總本金 107.2512 107.2512 107.2512 107.2512 107.2512 總利息 73.4087 80.6961 88.2958 96.1914 104.4066 總報酬率 68.45% 75.24% 82.33% 89.69% 97.35%

欲索取槓桿投資的原始Excel檔

請加賴: @wvr5039s,傳訊1

近期留言