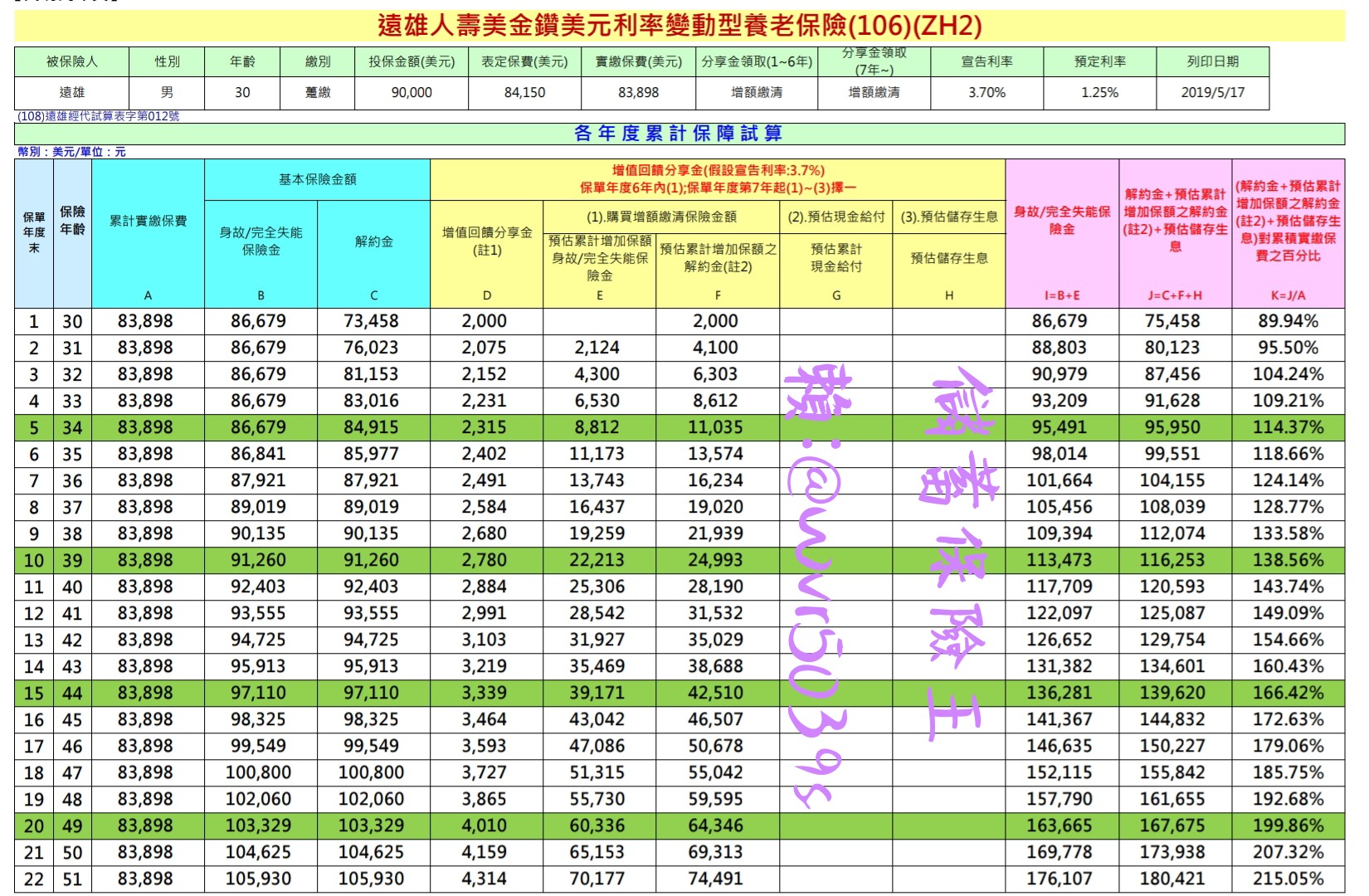

以下建議書由保經業務提供,

這是一張30年期養老險,

最長可以放到30年強迫解約,

建議書打的是最高折扣

保額9萬美金,

保費約8.4美金

~260萬台幣

高保額折扣:

3~6萬美金: 0.1%

(保費約2.8萬USD~87萬NTD)

6~9萬美金: 0.2%

(保費約5.6萬USD~174萬NTD)

9萬美金以上: 0.3%

(保費約8.4萬USD~260萬NTD)

目前宣告利率3.7%

本文以宣告利率維持3.7%不變計算IRR

主要參考最後一欄的解約金/實繳保費

IRR(內部報酬率)

時間單位不一定要用”年”

只是最常使用“年”

若以年為單位

計算方式可以看以下幾篇文章:

IRR(內部報酬率):計算六年IRR,為何要將六年末解約金放在現金流的第”七”欄位

解約金應該要計算年度末+1天

或次年度初

才比年度末合理,

原因可以看以下文章:

但這張美金鑽(ZH2)僅有提供年度末解約金

六年內IRR算出來的結果

會比其他商品吃虧

不同折扣IRR統整在前:

儲蓄保險王 賴: @wvr5039s FB: 儲蓄保險王 台幣保費門檻 260萬 174萬 87萬 折扣: 0.3% 0.2% 0.1% 0% 年 IRR IRR IRR IRR 1 -10.06% -10.15% -10.24% -10.33% 2 -2.28% -2.32% -2.37% -2.42% 3 1.3941% 1.3602% 1.3264% 1.2926% 4 2.2272% 2.2016% 2.1760% 2.1505% 5 2.7219% 2.7013% 2.6808% 2.6602% 6 2.8927% 2.8755% 2.8584% 2.8412% 7 3.1375% 3.1227% 3.1080% 3.0932% 8 3.2113% 3.1984% 3.1855% 3.1726% 9 3.2694% 3.2579% 3.2464% 3.2349% 10 3.3152% 3.3048% 3.2945% 3.2842% 11 3.3536% 3.3442% 3.3348% 3.3254% 12 3.3842% 3.3756% 3.3670% 3.3584% 13 3.4113% 3.4033% 3.3953% 3.3874% 14 3.4341% 3.4266% 3.4192% 3.4119% 15 3.4540% 3.4471% 3.4402% 3.4333% 16 3.4713% 3.4648% 3.4584% 3.4519% 17 3.4862% 3.4801% 3.4740% 3.4679% 18 3.5001% 3.4943% 3.4886% 3.4828% 19 3.5122% 3.5068% 3.5013% 3.4958% 20 3.5229% 3.5177% 3.5125% 3.5074%

0.3%折扣(保費約8.4萬USD~260萬NTD)

FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 FB: 儲蓄保險王 宣告 表定保費 100.3 折扣 美金鑽 2% 賴: @wvr5039s 3.7% 實繳保費 100.0 0.3% 解約金 定存 美金儲蓄險勝出 年 解約金 IRR 總報酬率 增加率 總報酬率 絕對利差 相對利差 1 89.94 -10.06% -10.06% 2.00% 2 95.5 -2.28% -4.50% 4.04% 3 104.24 1.39% 4.24% 6.12% 4 109.21 2.23% 9.21% 4.77% 8.24% 0.24% 11.74% 5 114.37 2.72% 14.37% 4.72% 10.41% 0.79% 38.08% 6 118.66 2.89% 18.66% 3.75% 12.62% 1.01% 47.91% 7 124.14 3.14% 24.14% 4.62% 14.87% 1.32% 62.36% 8 128.77 3.21% 28.77% 3.73% 17.17% 1.45% 67.61% 9 133.58 3.27% 33.58% 3.74% 19.51% 1.56% 72.13% 10 138.56 3.32% 38.56% 3.73% 21.90% 1.67% 76.08% 11 143.74 3.35% 43.74% 3.74% 24.34% 1.76% 79.73% 12 149.09 3.38% 49.09% 3.72% 26.82% 1.86% 83.01% 13 154.66 3.41% 54.66% 3.74% 29.36% 1.95% 86.17% 14 160.43 3.43% 60.43% 3.73% 31.95% 2.03% 89.16% 15 166.42 3.45% 66.42% 3.73% 34.59% 2.12% 92.04% 16 172.63 3.47% 72.63% 3.73% 37.28% 2.21% 94.83% 17 179.06 3.49% 79.06% 3.72% 40.02% 2.30% 97.53% 18 185.75 3.50% 85.75% 3.74% 42.82% 2.38% 100.24% 19 192.68 3.51% 92.68% 3.73% 45.68% 2.47% 102.89% 20 199.86 3.52% 99.86% 3.73% 48.59% 2.56% 105.50%

0.2%折扣(保費約5.6萬USD~174萬NTD)

FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 FB: 儲蓄保險王 宣告 表定保費 100.3 折扣 美金鑽 2% 賴: @wvr5039s 3.7% 實繳保費 100.1 0.2% 解約金 定存 美金儲蓄險勝出 年 解約金 IRR 總報酬率 增加率 總報酬率 絕對利差 相對利差 1 89.94 -10.15% -10.15% 2.00% 2 95.5 -2.32% -4.59% 4.04% 3 104.24 1.36% 4.14% 6.12% 4 109.21 2.20% 9.10% 4.77% 8.24% 0.21% 10.41% 5 114.37 2.70% 14.26% 4.72% 10.41% 0.77% 36.97% 6 118.66 2.88% 18.54% 3.75% 12.62% 0.99% 46.97% 7 124.14 3.12% 24.02% 4.62% 14.87% 1.31% 61.53% 8 128.77 3.20% 28.64% 3.73% 17.17% 1.43% 66.85% 9 133.58 3.26% 33.45% 3.74% 19.51% 1.55% 71.44% 10 138.56 3.30% 38.42% 3.73% 21.90% 1.65% 75.45% 11 143.74 3.34% 43.60% 3.74% 24.34% 1.75% 79.14% 12 149.09 3.38% 48.94% 3.72% 26.82% 1.84% 82.45% 13 154.66 3.40% 54.51% 3.74% 29.36% 1.93% 85.64% 14 160.43 3.43% 60.27% 3.73% 31.95% 2.02% 88.65% 15 166.42 3.45% 66.25% 3.73% 34.59% 2.11% 91.56% 16 172.63 3.46% 72.46% 3.73% 37.28% 2.20% 94.37% 17 179.06 3.48% 78.88% 3.72% 40.02% 2.29% 97.09% 18 185.75 3.49% 85.57% 3.74% 42.82% 2.37% 99.80% 19 192.68 3.51% 92.49% 3.73% 45.68% 2.46% 102.47% 20 199.86 3.52% 99.66% 3.73% 48.59% 2.55% 105.09%

0.1% 折扣(保費約2.8萬USD~87萬NTD)

FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 FB: 儲蓄保險王 宣告 表定保費 100.3 折扣 美金鑽 2% 賴: @wvr5039s 3.7% 實繳保費 100.2 0.1% 解約金 定存 美金儲蓄險勝出 年 解約金 IRR 總報酬率 增加率 總報酬率 絕對利差 相對利差 1 89.94 -10.24% -10.24% 2.00% 2 95.5 -2.37% -4.69% 4.04% 3 104.24 1.33% 4.03% 6.12% 4 109.21 2.18% 8.99% 4.77% 8.24% 0.19% 9.09% 5 114.37 2.68% 14.14% 4.72% 10.41% 0.75% 35.88% 6 118.66 2.86% 18.42% 3.75% 12.62% 0.97% 46.03% 7 124.14 3.11% 23.89% 4.62% 14.87% 1.29% 60.69% 8 128.77 3.19% 28.51% 3.73% 17.17% 1.42% 66.10% 9 133.58 3.25% 33.31% 3.74% 19.51% 1.53% 70.76% 10 138.56 3.29% 38.28% 3.73% 21.90% 1.64% 74.82% 11 143.74 3.33% 43.45% 3.74% 24.34% 1.74% 78.55% 12 149.09 3.37% 48.79% 3.72% 26.82% 1.83% 81.90% 13 154.66 3.40% 54.35% 3.74% 29.36% 1.92% 85.12% 14 160.43 3.42% 60.11% 3.73% 31.95% 2.01% 88.15% 15 166.42 3.44% 66.09% 3.73% 34.59% 2.10% 91.08% 16 172.63 3.46% 72.29% 3.73% 37.28% 2.19% 93.91% 17 179.06 3.47% 78.70% 3.72% 40.02% 2.28% 96.64% 18 185.75 3.49% 85.38% 3.74% 42.82% 2.36% 99.37% 19 192.68 3.50% 92.30% 3.73% 45.68% 2.45% 102.04% 20 199.86 3.51% 99.46% 3.73% 48.59% 2.54% 104.68%

0%折扣:

FB: 儲蓄保險王 賴: @wvr5039s 儲蓄保險王 FB: 儲蓄保險王 宣告 表定保費 100.3 折扣 美金鑽 2% 賴: @wvr5039s 3.7% 實繳保費 100.3 0.0% 解約金 定存 美金儲蓄險勝出 年 解約金 IRR 總報酬率 增加率 總報酬率 絕對利差 相對利差 1 89.94 -10.33% -10.33% 2.00% 2 95.5 -2.42% -4.79% 4.04% 3 104.24 1.29% 3.93% 6.12% 4 109.21 2.15% 8.88% 4.77% 8.24% 0.16% 7.77% 5 114.37 2.66% 14.03% 4.72% 10.41% 0.72% 34.78% 6 118.66 2.84% 18.31% 3.75% 12.62% 0.95% 45.09% 7 124.14 3.09% 23.77% 4.62% 14.87% 1.27% 59.86% 8 128.77 3.17% 28.38% 3.73% 17.17% 1.40% 65.36% 9 133.58 3.23% 33.18% 3.74% 19.51% 1.52% 70.08% 10 138.56 3.28% 38.15% 3.73% 21.90% 1.62% 74.19% 11 143.74 3.33% 43.31% 3.74% 24.34% 1.72% 77.96% 12 149.09 3.36% 48.64% 3.72% 26.82% 1.82% 81.34% 13 154.66 3.39% 54.20% 3.74% 29.36% 1.91% 84.59% 14 160.43 3.41% 59.95% 3.73% 31.95% 2.00% 87.65% 15 166.42 3.43% 65.92% 3.73% 34.59% 2.09% 90.60% 16 172.63 3.45% 72.11% 3.73% 37.28% 2.18% 93.45% 17 179.06 3.47% 78.52% 3.72% 40.02% 2.26% 96.19% 18 185.75 3.48% 85.19% 3.74% 42.82% 2.35% 98.94% 19 192.68 3.50% 92.10% 3.73% 45.68% 2.44% 101.62% 20 199.86 3.51% 99.26% 3.73% 48.59% 2.53% 104.27%

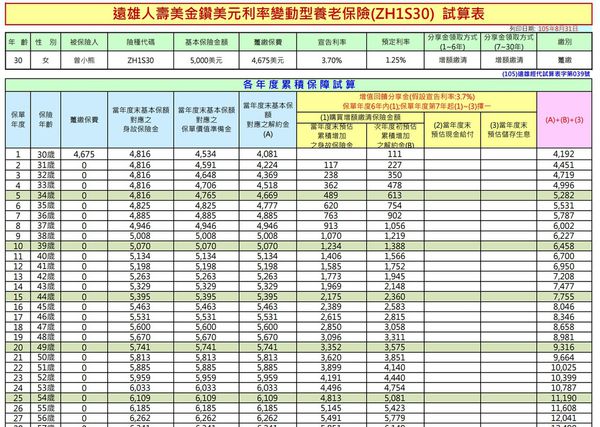

先前也有介紹過遠雄美金鑽:

遠雄人壽美金鑽美元利率變動型養老保險(ZH1S30,7年IRR>3%練習題)

遠雄人壽美金鑽美元利率變動型養老保險(ZH1S30,密碼解密)

可以看到撰文越來越詳細

從一開始只有IRR

到現在,除了不同折扣的IRR以外

還有總報酬率,解約金增加率

跟定存的絕對利差與相對利差

大家想看的資料不一樣

儘量把集結大家想看的資料

近期留言